Ocean Freight Rates Stabilize After Volatile Year: What Shippers Need to Know for 2026

After one of the most turbulent periods in modern maritime history, ocean freight rates are finally showing signs of stabilization as we enter 2026. The past year saw unprecedented volatility driven by geopolitical conflicts, supply chain disruptions, and shifting trade patterns. For shippers, freight forwarders, and logistics professionals, understanding these rate trends is crucial for budgeting and planning in the year ahead.

The Roller Coaster of 2025: A Year in Review

The year 2025 will be remembered as a period of extreme fluctuation in container shipping rates, characterized by dramatic spikes followed by equally sharp corrections. Let's examine the key events that shaped this volatile landscape.

Q1 2025: The Red Sea Crisis Escalates

The year began with freight rates surging by 180-200% on certain routes as the Red Sea security situation deteriorated. Houthi attacks on commercial vessels forced major shipping lines to abandon the Suez Canal route, opting instead for the longer Cape of Good Hope passage.

Impact on Major Trade Lanes:

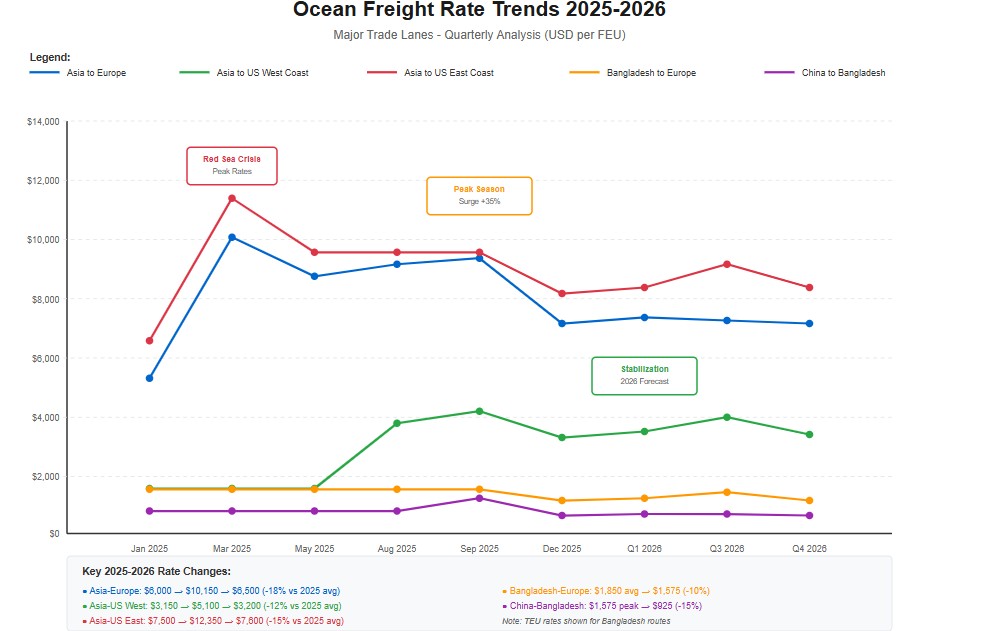

Asia to Europe:

- January 2025: $5,800-$6,200 per FEU (Forty-foot Equivalent Unit)

- Peak (March 2025): $9,500-$10,800 per FEU

- Increase: 65-75%

Asia to US East Coast:

- January 2025: $7,200-$7,800 per FEU

- Peak (March 2025): $11,500-$13,200 per FEU

- Increase: 60-69%

The longer routing added 10-14 days to transit times and consumed approximately 40% more fuel per voyage, directly impacting freight economics.

Q2 2025: Supply Chain Adjustments

As the industry adapted to the new normal, rates began to moderate slightly. Shipping lines deployed additional vessels to maintain schedule reliability, but capacity remained constrained.

Key Developments:

- Alliance Restructuring: Major shipping alliances reshuffled their networks to optimize the Cape route

- Blank Sailings Reduced: Carriers minimized schedule cancellations as demand remained strong

- Bangladesh Trade Impact: Chittagong Port saw increased direct calls as shippers sought to minimize transshipment delays

Rate Stabilization (May-June 2025):

- Asia to Europe: Settled at $7,500-$8,200 per FEU (15% below peak)

- Asia to US East Coast: Stabilized at $9,800-$10,500 per FEU (14% below peak)

Q3 2025: The Perfect Storm

Just as markets were adjusting, a confluence of factors created another spike:

- Panama Canal Water Restrictions: Continued drought limited daily transits to 24 vessels (down from normal 36-38)

- Peak Season Demand: Traditional back-to-school and holiday inventory building

- Labor Negotiations: US East Coast port labor contract uncertainties created rush shipping

- Typhoon Season Disruptions: Multiple port closures in Asia affected schedule reliability

Peak Season Rate Surge (August-September 2025):

- Transpacific (Asia-US West Coast): $4,800-$5,400 per FEU (up 35% from Q2)

- Asia-Europe: $8,900-$9,600 per FEU (up 18% from Q2)

- Intra-Asia: $800-$1,200 per TEU (up 25% from Q2)

Q4 2025: The Great Correction

As traditional peak season ended and capacity finally caught up with demand, rates entered a corrective phase:

October 2025:

- Major carriers announced General Rate Increases (GRIs) but struggled to make them stick

- Spot rates began declining as cargo volumes normalized

- Contract negotiations for 2026 became increasingly competitive

November-December 2025:

- Asia-Europe: Dropped to $6,200-$6,800 per FEU (down 30% from September peak)

- Asia-US West Coast: Fell to $3,200-$3,600 per FEU (down 33% from September)

- Asia-US East Coast: Declined to $7,500-$8,200 per FEU (down 24% from September)

By year-end, rates had returned to levels 40-50% higher than pre-Red Sea crisis (December 2024) but significantly below the 2025 peaks.

Current Market Conditions (January 2026)

As we enter 2026, several factors are contributing to market stabilization:

1. Red Sea Route Normalization (Partial)

While the Suez Canal route remains risky, some carriers are selectively resuming transits:

- CMA CGM and Hapag-Lloyd announced limited Suez Canal service resumption

- MSC and Maersk continue Cape routing but with optimized schedules

- Insurance premiums remain elevated ($50,000-$100,000 additional per voyage)

Impact: Transit times improving by 3-5 days on select services, with slight rate reductions

2. Capacity Additions

New vessel deliveries in late 2025 and early 2026 are adding significant capacity:

- 32 ultra-large container vessels (ULCV) delivered in Q4 2025 (22,000+ TEU capacity each)

- Additional 58 vessels expected in Q1-Q2 2026

- Total capacity increase: Approximately 4.5% globally

Impact: Increased capacity is putting downward pressure on spot rates

3. Demand Softening

Global economic uncertainties are moderating cargo volumes:

- Chinese export growth: Slowing to 3-4% (down from 7-8% in 2024)

- US import volumes: Flat to slightly declining year-over-year

- European demand: Weak due to economic headwinds

Impact: Supply-demand balance shifting in favor of shippers

4. Contract Rate Stability

Unlike spot markets, contract rates (annual and quarterly) are showing remarkable stability:

Current Contract Rate Benchmarks (2026):

| Trade Lane | Contract Rate Range | vs. 2025 Average |

|---|---|---|

| Asia to US West Coast | $2,800-$3,400/FEU | -8% |

| Asia to US East Coast | $6,500-$7,200/FEU | -12% |

| Asia to Europe | $5,200-$6,000/FEU | -15% |

| Asia to Middle East | $1,800-$2,200/TEU | +5% |

| Intra-Asia | $600-$900/TEU | -10% |

Key Observation: Shippers who locked in annual contracts in Q4 2025 secured favorable rates compared to 2025 averages.

Bangladesh Trade Perspective

For Bangladeshi exporters and importers using Chittagong and Mongla ports, freight rate trends have unique characteristics:

Export Rates (Outbound from Bangladesh)

Bangladesh to Europe (Primarily RMG/Textiles):

- Current Rate: $1,400-$1,700 per TEU

- 2025 Average: $1,850 per TEU

- Trend: Declining due to improved Chittagong Port efficiency and increased direct services

- Outlook: Stable to slightly down in Q1 2026

Bangladesh to USA:

- To US East Coast: $2,800-$3,200 per TEU

- To US West Coast (via transshipment): $3,400-$3,800 per TEU

- 2025 Average: 15% higher than current

- Trend: Moderating as peak season ends

Bangladesh to Middle East:

- Current Rate: $450-$650 per TEU

- Trend: Stable, supported by consistent demand for Bangladeshi products

Import Rates (Inbound to Bangladesh)

China/Far East to Bangladesh:

- Current Rate: $800-$1,100 per TEU

- 2025 Peak (September): $1,500-$1,650 per TEU

- Trend: Declining sharply as volumes normalize

Europe to Bangladesh:

- Current Rate: $2,200-$2,600 per TEU

- Trend: Stable, less volatility on westbound lanes

India to Bangladesh:

- Current Rate: $350-$500 per TEU

- Trend: Increasing slightly due to growing bilateral trade

Special Considerations for Bangladesh Shippers

1. Direct Service Advantage:

Chittagong Port's improved infrastructure has attracted 15 new direct services in 2025, reducing reliance on expensive transshipment through Colombo or Singapore. This translates to:

- ✅ Cost savings: $200-$400 per container

- ✅ Time savings: 5-7 days faster transit

- ✅ Reliability improvements: Fewer missed connections

2. Currency Impact:

The Bangladesh Taka's relative stability against the USD in late 2025 has provided some relief to importers, offsetting freight cost increases.

3. Peak Season Planning:

Bangladeshi garment exporters should note that European and US retailers are now placing orders 6-8 weeks earlier than pre-pandemic norms due to supply chain unpredictability.

Key Factors Influencing 2026 Rates

Several variables will determine whether stabilization continues or volatility returns:

1. Geopolitical Developments

Red Sea Security:

- If security improves significantly, expect 15-20% rate reductions on Asia-Europe lanes

- Continued instability maintains current premium pricing

- Insurance markets remain key: War risk premiums add $75-$150 per TEU

Ukraine-Russia Situation:

- Ongoing conflict continues to impact Black Sea grain exports

- Alternate routing through Baltic and Mediterranean ports creates capacity constraints

- Energy costs remain elevated, affecting bunker fuel prices

Taiwan Strait Tensions:

- Any escalation could disrupt critical Asia-Pacific trade lanes

- Shippers diversifying manufacturing away from single-country dependencies

2. Environmental Regulations

IMO 2023 Carbon Intensity Requirements:

Ships must now reduce carbon intensity by 5% (2023-2025) and 7% (2026-2027) compared to 2019 baseline.

Impact on Freight Rates:

- Slow steaming (reduced speeds) increases transit times but reduces emissions

- Alternative fuels (LNG, methanol) adoption increases operational costs by 10-20%

- Carriers passing environmental compliance costs to shippers through Green Fuel Surcharges: $150-$300 per FEU

EU Emissions Trading System (ETS):

Starting January 2024, all ships calling at EU ports must purchase carbon allowances.

Current ETS Impact:

- Adds approximately $50-$80 per TEU to Europe-bound cargo

- Expected to increase to $100-$150 per TEU by 2027 as requirements phase in

3. Capacity Management

Shipping lines learned from the 2021-2022 overcapacity crisis and are managing capacity more conservatively:

Strategies Employed:

- Blank sailings: Strategic cancellations during low-demand periods

- Slow steaming: Reducing vessel speeds to absorb capacity while cutting fuel costs

- Tonnage scrapping: Accelerated retirement of older, less efficient vessels

- Alliance cooperation: Better coordination to avoid overcapacity on key lanes

2026 Capacity Outlook:

- Net capacity growth: 2.8-3.2% (after scrapping)

- Demand growth projection: 2.5-3.5%

- Balance: Relatively neutral, supporting rate stability

4. Port Congestion

Unlike 2021-2022, port congestion is largely resolved as of 2026:

Improvements:

- US West Coast ports: Operating at near-normal efficiency

- European ports: No significant backlogs (except occasional strike-related delays)

- Asian ports: Strong performance, particularly in China and Bangladesh

Remaining Challenges:

- Panama Canal: Water level restrictions continue limiting capacity

- Truck chassis shortages: Still affecting US inland distribution

- Warehouse space: Tight in major logistics hubs (Los Angeles, Rotterdam, Singapore)

5. Bunker Fuel Prices

Fuel represents 40-50% of total operating costs for container ships. Bunker prices directly impact freight rates.

Current Bunker Fuel Prices (January 2026):

- VLSFO (Very Low Sulfur Fuel Oil): $550-$580 per metric ton

- MGO (Marine Gas Oil): $720-$750 per metric ton

- LNG (Liquefied Natural Gas): $14-$16 per MMBtu

Trend: Relatively stable after 2025 volatility, with oil prices ranging $70-$85 per barrel.

Impact: Fuel surcharges (BAF/ECA) are stabilizing at $400-$600 per FEU for long-haul routes.

What Shippers Should Do Now

Given the current market conditions, here are actionable recommendations for businesses engaged in international trade:

1. Lock In Annual Contracts Early

Why: Contract rates are currently 8-15% below 2025 averages and significantly below peak spot rates.

Strategy:

- Negotiate annual contracts for 60-70% of your volume

- Keep 30-40% flexible for spot market opportunities

- Request quarterly review clauses to adjust if market drops further

Bangladesh Exporters: RMG exporters should secure Europe and US contracts by February 2026 before spring/summer buying season.

2. Diversify Carrier Relationships

Why: Over-reliance on a single carrier creates vulnerability to capacity shortages or service changes.

Strategy:

- Work with 2-3 primary carriers plus backup options

- Evaluate carriers on reliability, not just price

- Monitor carrier financial health (several lines struggled in 2025)

Bangladesh Context: With 15 new direct services at Chittagong, explore options beyond traditional feeder services through Colombo.

3. Optimize Inventory Management

Why: Transit time unpredictability makes inventory planning challenging.

Strategy:

- Safety stock: Maintain 2-3 weeks additional inventory for critical components

- Demand forecasting: Improve accuracy using AI/ML tools

- Nearshoring considerations: Evaluate regional sourcing for time-sensitive products

For Bangladeshi Importers: Raw material suppliers (textiles, chemicals) should stock 3-4 weeks ahead during monsoon season when port operations can be affected.

4. Leverage Consolidation Services

Why: LCL (Less than Container Load) has become significantly more efficient and cost-effective.

Strategy:

- For shipments under 10-12 CBM, LCL often beats FCL economics

- Use consolidators with direct services to your destination

- Weekly departures now available on major lanes

Bright Star Shipping Advantage: Our Chittagong consolidation services offer weekly departures to Europe, USA, and Middle East with competitive rates.

5. Implement Digital Tracking & Visibility

Why: Real-time tracking enables proactive problem-solving and customer communication.

Strategy:

- Request container-level GPS tracking from carriers

- Use platforms that integrate multiple carriers (Descartes, project44, FourKites)

- Set up automated alerts for delays or deviations

Bangladesh Digital Transformation: Chittagong Port's National Single Window (NSW) now provides real-time cargo status—leverage this for better planning.

6. Evaluate Alternative Routings

Why: Traditional routings may no longer be optimal given current geopolitical realities.

Strategy:

- Asia-Europe: Compare Suez vs. Cape routing based on urgency

- Bangladesh-USA: Evaluate direct services vs. transshipment economics

- Intra-Asia: Consider coastal shipping for India-Bangladesh trade

Cost-Benefit Example:

- Suez route (if available): $6,000/FEU, 32 days transit

- Cape route: $6,500/FEU, 45 days transit

- Decision factor: Is $500 worth 13 extra days? Depends on product margin and shelf life.

7. Negotiate Comprehensive Service Contracts

Why: Beyond base freight rates, many costs are hidden in surcharges and accessorials.

Strategy:

Negotiate all-inclusive rates covering:

- Base freight

- Bunker adjustment factors (BAF)

- Currency adjustment factors (CAF)

- Security surcharges

- Peak season surcharges

- Documentation fees

Request surcharge caps in contracts

Watch Out For:

- Carriers trying to separate GRI (General Rate Increases) from base contract rates

- "Emergency" surcharges that become permanent

8. Plan for Lunar New Year Early

Why: The 2026 Lunar New Year (January 29) will create the usual factory shutdowns and capacity crunches.

Strategy:

- Shift shipments earlier: December-early January to avoid pre-holiday rush

- Expect rate spikes: 20-30% premiums in the 2 weeks before LNY

- Plan production schedules: Account for 2-3 week factory closures in China

Bangladesh Advantage: As a Muslim-majority country, Bangladesh doesn't observe Lunar New Year, providing export continuity when Chinese factories are closed.

Regional Rate Forecasts for 2026

Based on current market dynamics, here are our projections for major trade lanes:

Asia to North America

Transpacific (Asia-US West Coast):

- Q1 2026: $2,900-$3,500/FEU (stable)

- Q2 2026: $2,600-$3,200/FEU (slight decline post-LNY)

- Q3 2026: $3,800-$4,500/FEU (peak season increase)

- Q4 2026: $3,200-$3,800/FEU (post-peak normalization)

- Annual Average: $3,200/FEU (down 12% vs. 2025)

Asia to US East Coast (all-water):

- Q1 2026: $7,200-$7,800/FEU

- Q2 2026: $6,800-$7,400/FEU

- Q3 2026: $8,500-$9,200/FEU (peak season)

- Q4 2026: $7,500-$8,100/FEU

- Annual Average: $7,600/FEU (down 15% vs. 2025)

Key Factors:

- Panama Canal capacity constraints continue

- US import demand softening slightly

- Labor agreements reached (removing uncertainty premium)

Asia to Europe

Far East to North Europe:

- Q1 2026: $5,800-$6,400/FEU

- Q2 2026: $5,200-$5,800/FEU

- Q3 2026: $6,500-$7,200/FEU (moderate peak)

- Q4 2026: $5,800-$6,400/FEU

- Annual Average: $5,950/FEU (down 18% vs. 2025)

Far East to Mediterranean:

- Q1 2026: $5,500-$6,100/FEU

- Annual Average: $5,750/FEU (down 16% vs. 2025)

Key Factors:

- Gradual Suez Canal service resumption by some carriers

- Weak European consumer demand

- Surplus capacity on the trade lane

Intra-Asia

China/Korea/Japan to Southeast Asia:

- Q1 2026: $550-$750/TEU

- Annual Average: $650/TEU (down 12% vs. 2025)

China to Bangladesh:

- Q1 2026: $850-$1,050/TEU

- Annual Average: $925/TEU (down 15% vs. 2025)

Key Factors:

- Short-haul routes less impacted by fuel costs

- Strong regional trade growth

- Bangladesh manufacturing boom driving imports

Bangladesh Specific Routes

Bangladesh to Europe:

- Q1 2026: $1,450-$1,650/TEU

- Peak Season (Sep-Oct): $1,800-$2,000/TEU

- Annual Average: $1,575/TEU (down 10% vs. 2025)

Bangladesh to USA:

- Q1 2026: $2,900-$3,100/TEU

- Annual Average: $3,050/TEU (down 8% vs. 2025)

Outlook: Bangladesh rates remain competitive due to improved port efficiency and direct services.

The Bigger Picture: Structural Changes in Ocean Freight

Beyond short-term rate fluctuations, the industry is experiencing fundamental transformations:

1. Carrier Consolidation

The top 10 carriers now control 85% of global capacity (up from 70% in 2015).

Implications:

- Less competition on many routes

- More market power for carriers in rate negotiations

- Shippers need stronger relationships and better negotiation strategies

2. Vertical Integration

Major carriers are acquiring logistics assets:

- Maersk: Now operates warehouses, trucking, and customs brokerage

- CMA CGM: Acquired CEVA Logistics (freight forwarding)

- MSC: Expanding into air freight and inland logistics

Impact: Carriers offering end-to-end solutions may provide better rates for bundled services.

3. Technology Transformation

Digital platforms are revolutionizing freight booking:

- Instant quoting: Real-time rates via APIs

- Blockchain documentation: Reducing paperwork and fraud

- AI-powered optimization: Route planning and capacity management

- IoT tracking: Container-level monitoring

Bangladesh Adoption: Chittagong Port's digitalization (NSW) positions Bangladesh well for this transition.

4. Sustainability Premium

Green shipping is no longer optional:

- Carbon-neutral shipping options: Available at 15-25% premium

- Biofuels and e-fuels: Gradually entering the market

- Regulatory compliance: EU ETS, IMO 2030 targets driving costs up

Customer Demand: Major European and US retailers (H&M, Walmart, Amazon) requiring sustainable shipping from suppliers.

5. Nearshoring and Friendshoring

Geopolitical tensions are reshaping supply chains:

- China+1 strategy: Diversification to Vietnam, Bangladesh, India

- Mexico boom: Nearshoring to serve North American market

- European reshoring: Some manufacturing returning from Asia

Bangladesh Opportunity: Positioned as a "China+1" destination, particularly for textiles, pharmaceuticals, and light manufacturing.

Conclusion: Navigating the New Normal

The stabilization of ocean freight rates in early 2026 offers a welcome respite after the volatility of 2025. However, "stable" doesn't mean "cheap"—rates remain 35-45% higher than pre-pandemic (2019) levels and are unlikely to return to those low points.

Key Takeaways:

- Current market favors shippers: Use this opportunity to negotiate favorable annual contracts

- Volatility risks remain: Red Sea, Panama Canal, and geopolitical factors could disrupt again

- Bangladesh advantage: Improved port infrastructure and direct services provide competitive edge

- Long-term planning essential: Don't just optimize for current rates; prepare for potential disruptions

- Sustainability matters: Green shipping requirements will increasingly impact costs and supplier selection

For Bangladeshi businesses:

The combination of stabilizing freight rates, improving port efficiency at Chittagong, and Bangladesh's growing manufacturing base creates a favorable environment for international trade growth in 2026. However, proactive planning and diversified strategies remain essential.

At Bright Star Shipping, we continuously monitor market conditions and leverage our relationships with major carriers to secure competitive rates and reliable service for our clients. Whether you're exporting ready-made garments to Europe, importing raw materials from China, or managing complex supply chains, we provide the expertise and solutions needed to navigate today's freight market.

Need Help Optimizing Your Freight Costs?

Contact Bright Star Shipping for:

- ✅ Real-time rate quotes for your specific lanes

- ✅ Contract negotiation support with major carriers

- ✅ Supply chain consulting to reduce total logistics costs

- ✅ Customs clearance and documentation services

📧 Email: tajuddin@brightshipping-bd.com

📞 Phone: +880-1917-433445

📍 Location: Chittagong, Bangladesh

Related Articles You Might Find Useful:

Have questions about current freight rates for your specific route? Leave a comment below or contact us directly for a customized quote!